The age of majority in Nova Scotia is 19, which is the age you can obtain a credit card without a co-sign from your parents. I received my first credit card when I was 16 years old. My parents had opened an additional card on their account in my name and I was instructed to use it for emergencies only.

For three years, I only used the card a few times for emergency car repairs or when my parents wanted me to purchase something on their behalf. During that time, I never saw the credit card bills and was unaware of exactly how credit cards worked. Leading up to my 19th birthday I was excited to be able to get my own credit card and begin building my credit. However, since I had never paid the bill, I did not understand how the whole process actually worked.

In my teenage years I was told stories about credit cards by adults or friends who were older than me. I heard numerous stories about people who had racked up debt that they were not able to pay back and subsequently ruined their credit scores. A lot of the stories were scary and put a very negative spin on credit cards. But, meanwhile, I actually had a credit card and my parents each had at least one credit card and none of us had ended up in this terrible situation. Something didn’t add up so I decided to educate myself on credit cards.

A lot of people don’t understand how useful a credit card can be. Their lack of knowledge about credit cards scares them from getting one or keeps them from getting the most out of their existing card. I want to share my research and experience using credit cards over the years to help others. For anyone who does not know much about credit cards or is scared of them, here are the basics. I will discuss a few terms to get things started.

Issuer

The issuer is the company that provides the credit card. The big three companies on a global scale are Visa, Mastercard and American Express.

Partnership

Individuals rarely get a credit card directly from the issuer. Instead, banks or other companies partner with issuers to provide credit cards to their customers.

Annual fee

This is the fee you are required to pay each year to be able to use the credit card. Some cards have no annual fee but some can be up to a few hundred dollars.

Closing Balance

The amount that will appear on your monthly statement, which you are required to pay. This is different from your current balance, which will fluctuate with payments and purchases.

Interest Rate

This is the rate you will pay on your closing balance if it is not paid by the due date indicated on your monthly statement. Low interest rate cards can be around 10% per annum but most regular cards will have an interest rate between 18-21% per annum.

Credit Limit

This is the amount of spending that has been approved for you to use. This limit will be decided based on your financial details in your credit card application.

Grace period

This is the period of time between the end of your billing cycle and your monthly statement due date. During this time you will not be charged interest on your closing balance. A typical grace period is 14 days. However, some companies use the term “interest free period”, which includes the 30 days of your billing cycle plus the grace period. A typical interest free period would therefore be 44 days.

Benefits

Credit card issuers are companies. The same as any company you have ever come across. They compete against each other for your business and, to do this, they offer you benefits for signing with them. Common benefits include “cash-back” rewards or receiving frequent flyer points to a particular programme. I will discuss this in more detail later.

All of these details are stated when applying for a credit card or can be found in the fine print. It is very important to read the fine print to know how best to manage your card.

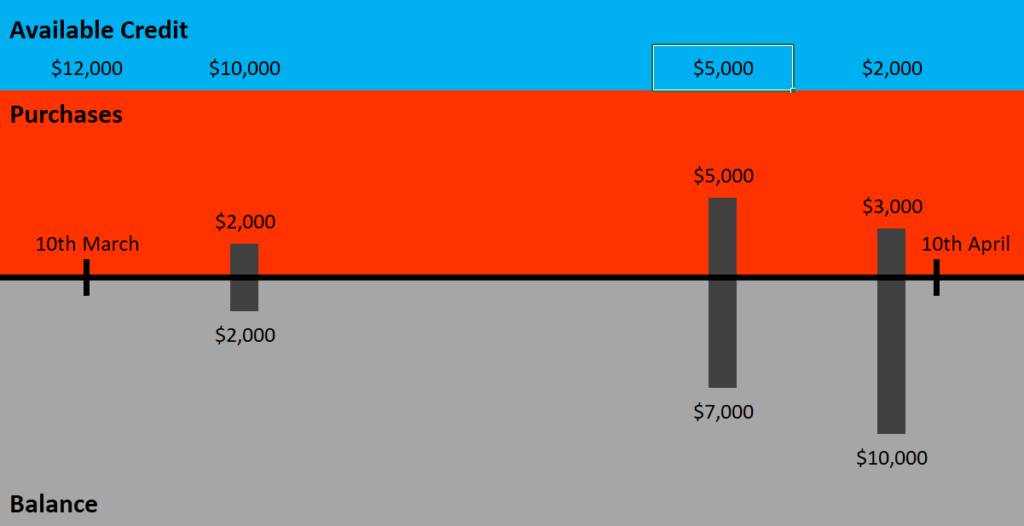

The following example will use these terms to illustrate a typical month of using a credit card. John’s billing cycle runs from 10th March to 10th April. He has a credit limit of $12,000 and an interest rate of 20% per annum. John makes a purchase of $2,000 on 16th March, a purchase of $5,000 on 2nd April and a purchase of $3,000 on 8th April.

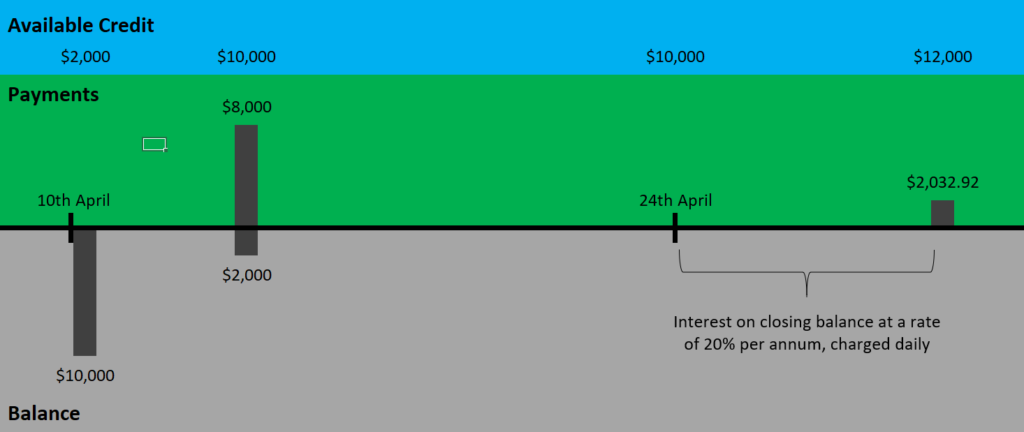

John receives his statement on 10th April for $10,000. Now, he only has $2,000 of available credit until he begins to make payments His statement due date is 24th April. John pays $8,000 on 14th April and then is not able to pay the remaining amount until 30th April. Without interest his remaining amount would have been $2,000 but with interest, John is required to pay $2,032.92.

The additional $32.92 was calculated based on his closing balance of $10,000 at an interest rate of 20% per annum over the six days that exceeded his due date. In this example the closing balance was a large amount, but was paid after six days. If large sums of money go unpaid for long periods of time the compounded interest can begin to become quite significant.

After my research, when I was 18, I concluded that people who do not manage their money properly or spend beyond their means can get into trouble. I realised that this was the source of the negative stories I had hear about credit cards.

When I researched credit cards I realised that they were a tool. Credit cards allow us to purchase items now and differ the payments until the due date. This means we can purchase items sooner and begin using them, instead of waiting for a pay cheque to clear before making a purchase.

Have you ever been saving up to buy something and knew you would have enough once your pay cheque cleared in five days? Instead of waiting five days, you can purchase the item with your credit card and then pay it off when your pay cheque clears. In short, I view credit cards as a tool to get me what I want sooner.

As long as you pay your credit card bill in full before the due date each month, you will never have to pay interest on a credit card. Since I turned 19, I have never paid one cent of interest on a credit card. I have done this by monitoring how much I spend versus how much I am projected to make before my statement due date. If I know I will have $3,000 in my bank account by my due date, then I am happy to spend up to this amount during my billing cycle. Purchases can be made at any time, regardless of how much is in my account at any given time. When my due date arrives, I pay my card in full and then do not have to pay interest. Monitoring your spending versus your projected earnings is the key to never paying interest and getting things sooner.

As I previously mentioned, credit card companies will offer you benefits to use their cards. Some will offer a percentage of your statement total back to you as a “cash‑back” reward. However, my personal favourite is to earn frequent flyer points.

I currently have an Air New Zealand Airpoints Mastercard. My card gives me $1 worth of Airpoints (equal to $1 NZD) for every $75 NZD I spend. My card has an annual fee of $150. Doing the math, my break-even point, where my Airpoints earned offsets my annual fee, is $11,250 spending per year. Before I applied for my card, I calculated what my annual spending would be and determined it would exceed this amount. Therefore, I concluded that it was beneficial for me to use this credit card.

If you are interested in a rewards based credit card, it is important to do this step to make sure the annual fee will not exceed the rewards you will receive.

I also determined that it was beneficial for me to pay for as many things as possible using my credit card. The more I spend, the more Airpoints I accumulate. The more Airpoints I accumulate, the sooner I can pay for my next holiday. As long as the merchant accepts credits cards, I will use mine, regardless of the cost of the transaction.

Since receiving my first credit card at 19, I have be able to pay for my flights to go on at least one holiday each year using frequent flyer points. I have been successful at making credit cards work in my favour by researching them and understanding exactly how they work.

I would like people to take my advice from this blog post and begin applying it to their lives to reap their own travel benefits.

Earning frequent flyer points or receiving “cash‑back” rewards are direct benefits. I have also mentioned the indirect benefits of credit cards, such as them allowing you to get things sooner. There are many more benefits that come with credit cards and I will explore these in my subsequent posts in this series.

Tips and Rules to Follow:

– Always read the fine print before applying for a credit card

– Credit cards are a tool to help you get what you want sooner

– Do not over spend on your card

– Monitor your spending versus your projected earnings

– Ensure your annual fees do not exceed your rewards

– If your rewards are based on your total spend, use your card as much as possible

Remember, a credit card is a tool. You wouldn’t build a house without a hammer, don’t go through life without a credit card.

Are you getting the most out of your credit card? What benefits do you enjoy? Let me know in the comments below.

Make sure to read my next post on Frequent Flyer Points, which will continue with credit card travel benefits. Want to be notified when new blog posts are uploaded? Subscribe below.

Dave has been on a mission, since 2010, to cross off the 100 items on his bucket list. The stories of his adventures are complimented by life lessons learned along the way and his travel tips are unique to his experiences.